The goal of AssetAllocation is to perform backtesting of customizable asset allocation strategies. The main function that the user interacts with is backtest_allocation().

You can install the development version of AssetAllocation from GitHub with:

# install.packages("devtools")

devtools::install_github("rubetron/AssetAllocation")Simple example using pre-loaded strategy (see the vignette for other examples):

library(AssetAllocation)

#> Registered S3 method overwritten by 'quantmod':

#> method from

#> as.zoo.data.frame zoo

## Example 1: backtesting one of the asset allocations in the package

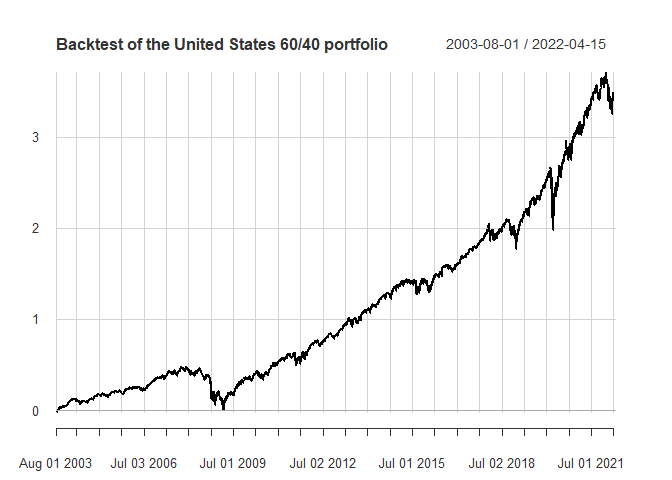

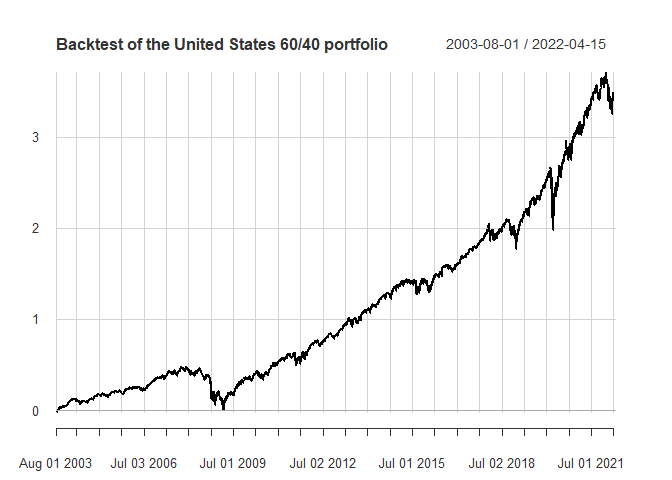

us_60_40 <- asset_allocations$static$us_60_40

# test using the data set provided in the package

bt_us_60_40 <- backtest_allocation(us_60_40,

ETFs$Prices,

ETFs$Returns,

ETFs$risk_free)

# plot returns

library(PerformanceAnalytics)

#> Loading required package: xts

#> Loading required package: zoo

#>

#> Attaching package: 'zoo'

#> The following objects are masked from 'package:base':

#>

#> as.Date, as.Date.numeric

#>

#> Attaching package: 'PerformanceAnalytics'

#> The following object is masked from 'package:graphics':

#>

#> legend

chart.CumReturns(bt_us_60_40$returns,

main = paste0("Backtest of the ",

bt_us_60_40$strat$name,

" portfolio"),

ylab = "Cumulative returns"

)

# show table with performance metrics

bt_us_60_40$table_performance

#> United.States.60.40

#> Annualized Return 0.0803

#> Annualized Std Dev 0.1013

#> Annualized Sharpe (Rf=1.18%) 0.6669

#> daily downside risk 0.0045

#> Annualised downside risk 0.0718

#> Downside potential 0.0019

#> Omega 1.1466

#> Sortino ratio 0.0618

#> Upside potential 0.0022

#> Upside potential ratio 0.6175

#> Omega-sharpe ratio 0.1466

#> Semi Deviation 0.0046

#> Gain Deviation 0.0046

#> Loss Deviation 0.0053

#> Downside Deviation (MAR=210%) 0.0100

#> Downside Deviation (Rf=1.18%) 0.0045

#> Downside Deviation (0%) 0.0045

#> Maximum Drawdown 0.3260

#> Historical VaR (95%) -0.0093

#> Historical ES (95%) -0.0155

#> Modified VaR (95%) -0.0086

#> Modified ES (95%) -0.0086Another example creating a strategy from scratch, retrieving data from Yahoo Finance, and backtesting:

library(AssetAllocation)

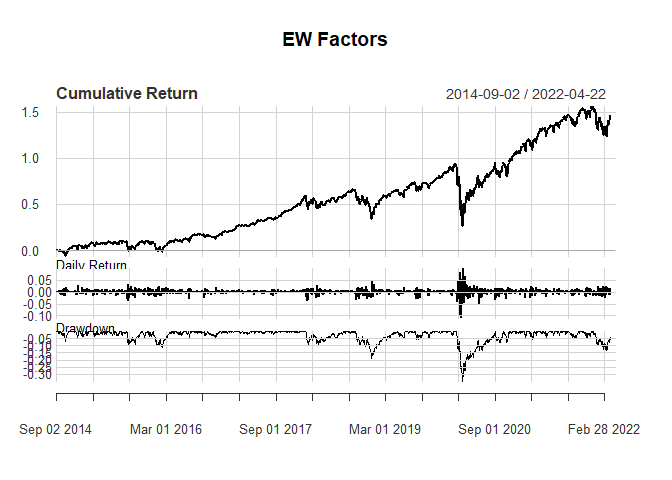

# create a strategy that invests equally in momentum (MTUM), value (VLUE), low volatility (USMV) and quality (QUAL) ETFs.

factors_EW <- list(name = "EW Factors",

tickers = c("MTUM", "VLUE", "USMV", "QUAL"),

default_weights = c(0.25, 0.25, 0.25, 0.25),

rebalance_frequency = "month",

portfolio_rule_fn = "constant_weights")

# get data for tickers using getSymbols

factor_ETFs_data <- get_data_from_tickers(factors_EW$tickers,

starting_date = "2013-08-01")

#> 'getSymbols' currently uses auto.assign=TRUE by default, but will

#> use auto.assign=FALSE in 0.5-0. You will still be able to use

#> 'loadSymbols' to automatically load data. getOption("getSymbols.env")

#> and getOption("getSymbols.auto.assign") will still be checked for

#> alternate defaults.

#>

#> This message is shown once per session and may be disabled by setting

#> options("getSymbols.warning4.0"=FALSE). See ?getSymbols for details.

# backtest the strategy

bt_factors_EW <- backtest_allocation(factors_EW,factor_ETFs_data$P, factor_ETFs_data$R)

# plot returns

charts.PerformanceSummary(bt_factors_EW$returns,

main = bt_factors_EW$strat$name,

)

# table with performance metrics

bt_factors_EW$table_performance

#> EW.Factors

#> Annualized Return 0.1233

#> Annualized Std Dev 0.1731

#> Annualized Sharpe (Rf=0%) 0.7125

#> daily downside risk 0.0078

#> Annualised downside risk 0.1246

#> Downside potential 0.0032

#> Omega 1.1652

#> Sortino ratio 0.0664

#> Upside potential 0.0037

#> Upside potential ratio 0.5665

#> Omega-sharpe ratio 0.1652

#> Semi Deviation 0.0081

#> Gain Deviation 0.0077

#> Loss Deviation 0.0094

#> Downside Deviation (MAR=210%) 0.0125

#> Downside Deviation (Rf=0%) 0.0078

#> Downside Deviation (0%) 0.0078

#> Maximum Drawdown 0.3499

#> Historical VaR (95%) -0.0161

#> Historical ES (95%) -0.0266

#> Modified VaR (95%) -0.0151

#> Modified ES (95%) -0.0168